Why Your Credit Score Is Important: The Secret to Unlocking Better Financial Opportunities

Why Your Credit Score Is Important: The Secret to Unlocking Better Financial Opportunities

Learn How Your Credit Score Can Make or Break Your Chances for Lower Interest Rates, Loan Approvals, and Financial Freedom—Plus How to Improve It Fast

Your credit score is more than just a three-digit number—it’s a key that unlocks the doors to better financial opportunities. Whether you want to buy a house, a car, or even start a business, your credit score will play a significant role in whether you qualify for a loan and what kind of interest rate you receive. In this post, we’ll break down why your credit score is so important, how it’s calculated, and, most importantly, what you can do to improve it.

What Is a Credit Score?

A credit score is a numerical representation of your creditworthiness. It’s used by lenders to determine whether or not to lend you money, how much to lend, and at what interest rate. The higher your credit score, the more favorable the terms of your loans will be. Essentially, your credit score reflects how well you've managed your financial obligations.

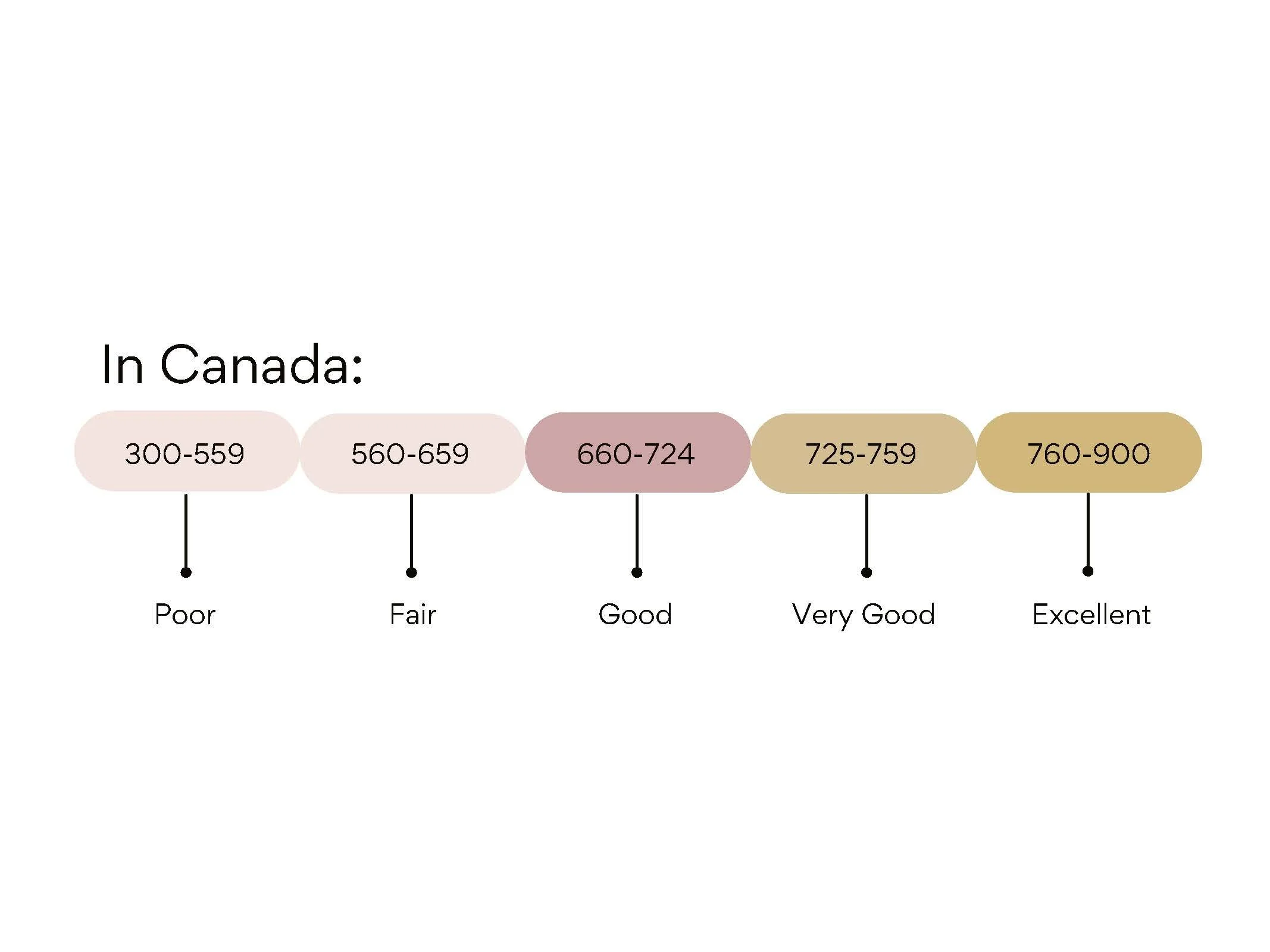

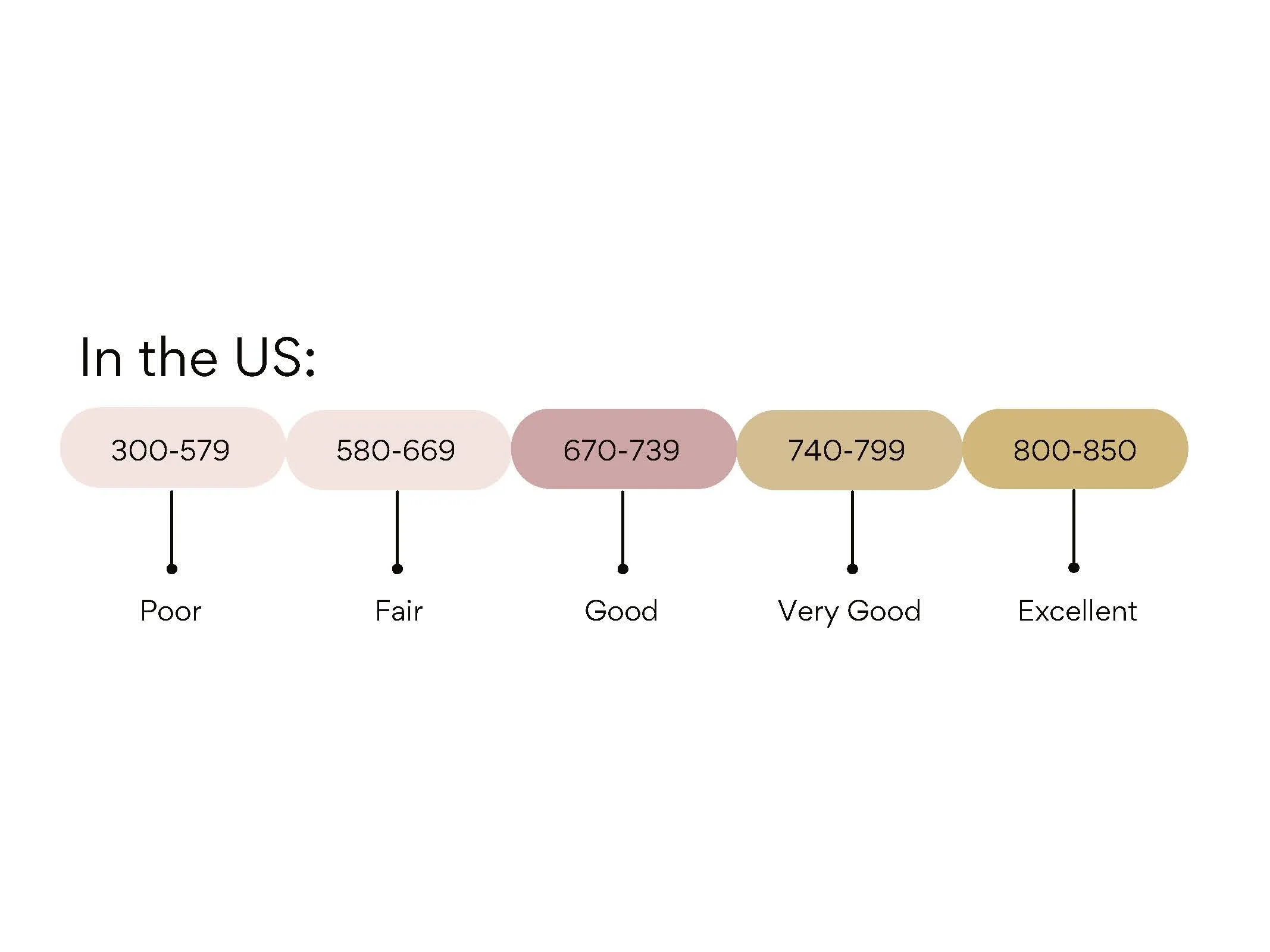

In both Canada and the United States, credit scores typically range from 300 to 850, with higher scores representing lower risk to lenders.

Why Does Your Credit Score Matter?

Your credit score is critical because it impacts a variety of financial decisions. Some of the most common instances where your credit score will be evaluated include:

Applying for a mortgage: A good credit score helps you secure a lower interest rate on your mortgage, which can save you thousands of dollars over the life of the loan.

Getting an auto loan: A high credit score increases your chances of being approved for an auto loan and getting a lower interest rate.

Starting a business: If you need a business loan, your personal credit score will be taken into account, especially if your business is new or small.

Securing a credit card: Your credit score determines your ability to get approved for a credit card, and also affects your credit limit and interest rate.

Renting an apartment: Landlords may check your credit score to assess your reliability in paying rent on time.

In essence, your credit score is a powerful tool that can help or hinder your ability to achieve your financial goals.

How Is Your Credit Score Calculated?

Your credit score is determined by five key factors, each contributing a different percentage to the total score:

35% Payment History: This is the most significant factor in your score. It reflects whether you’ve made your payments on time, including credit cards, loans, and mortgages. Missing payments or having accounts sent to collections can significantly damage your credit score.

30% Credit Utilization: This is the ratio of your current credit card balances to your credit limits. It’s recommended to keep your credit utilization below 30%. The higher your utilization, the more it can hurt your credit score.

15% Length of Credit History: The longer your credit history, the better it is for your credit score. This shows lenders that you’ve been managing credit responsibly over time.

10% New Credit: This includes the number of new credit accounts you’ve opened and the number of inquiries made on your credit report. Opening too many accounts in a short time can negatively impact your score.

10% Types of Credit Used: This factor considers the mix of credit you have, including credit cards, mortgage loans, student loans, and car loans. A healthy mix of credit types can help boost your score.

Credit Score Ranges

While the exact numbers may differ slightly between Canada and the U.S., here is a general breakdown of credit score ranges:

Excellent (750-850): If your score falls in this range, you're likely to receive the best rates and terms for loans and credit cards.

Good (700-749): You have a solid credit history and can generally qualify for most loans and credit cards with favorable terms.

Fair (650-699): You may face slightly higher interest rates and may not qualify for all loan products.

Poor (600-649): You may be able to get loans or credit, but the terms will be less favorable, and you may need a co-signer or collateral.

Very Poor (below 600): If your score is below 600, it will be difficult to secure credit without extremely high interest rates, and you may be turned down entirely.

How Can Your Credit Score Affect Your Financial Life?

Your credit score plays a major role in almost every aspect of your financial life. Below are some examples of how it affects your financial opportunities:

1. Loan Approvals and Interest Rates

The primary reason your credit score matters is that it affects your ability to qualify for loans. Whether you’re buying a home, purchasing a car, or borrowing for education, lenders use your credit score to assess risk. A higher score means you’re less likely to default on a loan, so they’ll offer you lower interest rates, saving you money in the long run.

2. Renting a Home

Many landlords use credit scores to assess potential tenants. A lower credit score may result in higher deposits or even a denial of the rental application. Conversely, a higher credit score can make renting smoother, as landlords view you as less risky.

3. Insurance Premiums

Did you know your credit score can impact how much you pay for car insurance? In some states in the U.S. and provinces in Canada, insurers use credit scores as one of the factors in determining your premiums. Those with better scores tend to pay lower premiums because insurers consider them less risky.

4. Employment Opportunities

Some employers check credit scores as part of the hiring process, particularly for positions that involve handling money or sensitive financial data. A poor credit score can hurt your chances of landing certain jobs.

5. Credit Card Approvals and Limits

Your credit score determines whether you’ll be approved for a credit card and what the terms will be. Those with higher scores typically receive higher credit limits and lower interest rates. Those with lower scores may be offered cards with high interest rates or even be declined entirely.

How to Check Your Credit Score

Checking your credit score regularly is essential for staying on top of your financial health. Here are some free options for checking your score:

In Canada: You can get your credit score for free from agencies like Equifax Canada and TransUnion Canada. Many banks also offer free credit score tracking for customers.

In the U.S.: You can access your credit score for free through the Annual Credit Report website, which allows you to request a free report from each of the three major credit bureaus—Equifax, Experian, and TransUnion—once every 12 months. Some financial institutions also provide free credit score tracking.

6 Ways to Improve Your Credit Score

Now that you understand why your credit score is important, let’s talk about how to improve it. Here are some strategies you can implement to boost your credit score and achieve better financial opportunities.

1. Pay Your Bills On Time

Payment history accounts for 35% of your credit score, making it the most important factor. Late payments, especially those that are over 30 days late, can severely damage your score. Set up automatic payments for bills or set reminders to ensure you never miss a due date.

2. Reduce Your Credit Card Balances

Credit utilization makes up 30% of your credit score. To improve this, try to keep your credit utilization below 30%. This means if you have a credit limit of $5,000, aim to keep your balance under $1,500. Paying down your balances can have an immediate positive impact on your score.

3. Don’t Open New Credit Accounts Too Frequently

Each time you apply for credit, a “hard inquiry” is made on your credit report, which can slightly lower your score. Opening several new accounts in a short period of time can make you look risky to lenders. Be mindful of how often you apply for new credit.

4. Keep Old Accounts Open

The length of your credit history accounts for 15% of your score. Keep older credit accounts open to show a long history of managing credit responsibly. If you must close an account, try to keep the oldest ones open to maintain your credit history length.

5. Diversify Your Credit Mix

Having a mix of different types of credit—credit cards, loans, mortgages—can help improve your score. However, only open new credit accounts if necessary. Don’t apply for credit just for the sake of improving your credit mix.

6. Dispute Errors on Your Credit Report

Mistakes happen, and sometimes your credit report can contain inaccuracies. Review your credit report regularly and dispute any errors you find. Getting inaccurate information removed can improve your score.

Moving Forward: Taking Control of Your Credit Score

Your credit score plays a critical role in your financial life. From loan approvals to interest rates, your credit score determines how much you can borrow and at what terms. By understanding the factors that influence your score and actively working to improve it, you can unlock better financial opportunities and make your dreams more achievable.

Remember, improving your credit score takes time, but with the right strategies, you’ll see the positive changes in your financial life. Start today, and take control of your credit health!

Explore More:

How to Make a Vision Board That Actually Works: Turn Your Goals into Reality – Discover the power of vision boards to clarify your goals, boost your motivation, and manifest financial success.

What Is Your Money Story? How It Shapes Your Financial Habits – Learn how your past influences your relationship with money and how to rewrite your story for success.

How to Let Go of Limiting Money Beliefs and Unlock Financial Freedom – Break free from the beliefs holding you back from achieving financial success.

Top Money Myths Debunked: The Truth About Wealth That Could Change Your Life – Break free from the money myths holding you back, shift your financial mindset, and start building the wealth you deserve.

How to Pay Off Debt Fast and Take Control of Your Money – Learn how to tackle your debt and achieve financial freedom faster.

Disclaimer:

This content is for informational purposes only and not legal, financial, or tax advice. Consult a qualified professional for advice specific to your situation. The Financial Confidence Coach is not liable for actions taken based on this information.